EFFECTS OF COVID 19 ON THE AVITION INDUSTRY

The change in the behavior of passengers following the COVID-19 crisis, travel restrictions, and the ensuing economic crisis have resulted in a dramatic drop in demand for airline services. According to IATA, passenger air transport measured as revenue passenger kilometer was down 90% year-on-year in April 2020 and still down 75% in August. The collapse in economic activity and trade affected freight, which was almost 30% lower year-on-year in April and still about 12% lower in August.

The size of the shock has put the liquidity buffers of airline companies under pressure, even if a significant share of its costs are variable (around 50% according to IATA, notably fuel accounting for 25% of the total costs) and the recent drop in oil prices has decreased airlines’ operating costs.

In the medium run, airline companies face two uncertainties:

- The cost of health-related measures.

- Operating costs are likely to increase in the short run for both airlines and airports because of additional health and safety requirements (e.g. disinfection, PPE, temperature checks, or viral tests) before they can be passed on to consumers. Moreover, if implemented for air transport, social distancing measures could force a reduction in the passenger load factor (i.e. the number of seats that can be occupied during a flight) by up to 50%.

- The shape of the recovery for commercial flights.

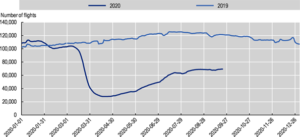

- International travel restrictions, the contraction of economic activity, and changes in transport behavior by cautious consumers may prevent a return to pre-crisis demand levels, even as lockdowns and domestic travel restrictions measures are loosened in many countries. Commercial air traffic is slow to recover: as of September 2020, the number of flights remains more than 40% below the pre-crisis level globally (Figure 1). This hides differences across flight lengths: the drop is even more pronounced for long-haul flights. In the longer run, changes in consumer behavior may result in structural changes in air transport demand. Even though the rebound of domestic flights in China suggests that traffic may revert to pre-crisis levels, a permanent drop in demand from pre-crisis levels cannot be excluded, either through modal shifts in services trade (e.g. video-conferencing instead of business travel) or, to a lesser extent, through substitution with other modes of transport (e.g. high-speed trains).

The combination of negative demand and supply shocks and the uncertainty around the medium-run outlook create an uncertain perspective for airline companies. Through inter-industry linkages, this uncertainty affects the whole aviation industry. Moreover, the industry remains exposed to a possible resurgence of the pandemic, as governments may impose new air travel restrictions to tackle flare-ups or a potential second wave of infections. This may threaten the existence of some firms in the industry, as production and revenues are likely to remain inferior to pre-crisis levels for some time.

Figure 1. Commercial air traffic, world

Number of flights tracked daily by Flightradar24, 2020 v. 2019

Note: 7-day moving average of the number of commercial flights tracked by Flightradar24 per day (UCT time). Commercial air traffic includes commercial passenger flights, cargo flights, charter flights, and some business jet flights; it does not include private flights, gliders, helicopter flights, ambulance flights, government flights, military flights, or drones.

Source: FlightRadar24 Statistics, flightradar24.com.

Airline companies were in very different situations before the COVID-19 crisis began. In particular, air transport is one of the sectors with the highest dispersion in productivity across firms and, to a lesser extent, in profitability. Thus, airline companies entered the crisis with strikingly different abilities to withstand such a shock and heterogeneous prospects for the future.

Bankruptcies or mergers and acquisitions among large companies could hurt competition in air transport, with possible repercussions on prices. Even if 80% of passenger seats are on routes with several carriers, many of these routes rely on a small number of firms (36% of routes involve only two or three carriers).

By: Mishal Riyaz